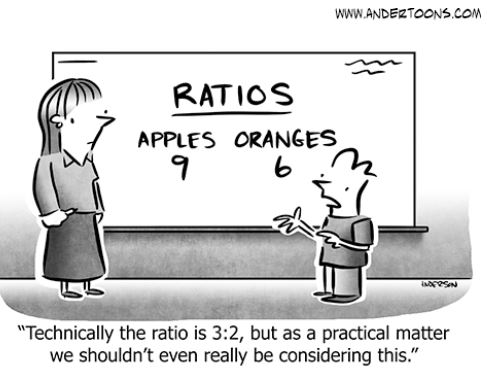

Kilby writes: This is another comic that CIDU Bill drafted in 2019, but never actually posted. I think most readers will get it pretty quickly, but I have to admit that it took me a moment before I figured out the point; perhaps the same thing happened to Bill as well.

“That’s comparing apples to oranges”

Teacher: You have 6 pieces of candy. I ask you for 3. How many do you have left?

First grader: 6

zbicyclist: Or the version I know is “You have six pieces of candy and three friends. What do you have left?” “Six pieces of candy and no friends.”

Here’s Watterson’s rendition of a similar gag:

The way I read it was “Technically the ratio is 3:2, but that would seem to say there are 3 apples and 2 oranges, which is not true, so as a practical matter we should not even consider reducing the fraction to lowest terms, not to mention that we shouldn’t be comparing apples to oranges anyway.”

Overthinking it, I noted that doing a ratio is comparing the number of apples to the number of oranges, which is not the same as comparing the apples to the oranges.

It made me think of Alice’s Adventures in Wonderland, where the name of the song is called “A-Sitting On A Gate,” but that’s just what the name is *called*. The actual name of the song is “Ways and Means.” The song, of which the name is “Ways and Means”, is called “The Aged Aged Man,” But that’s just what the song is *called* etc.

I believe it was Martin Gardner in his Annotated Alice notes who pointed out that when that discussion reaches “and the song really is…”, what follows should be not another name or title, but the speaker launching into singing the song!

The ratio has units of apples per orange, perfectly acceptable. You just can’t add or subtract them.

Ratios pretty much require dissimilar things. Even if it’s at a more abstract level, like “your apples” and “my apples”. I read a financial forum, where a frequent topic of discussion is conversions from traditional IRA to Roth IRA and deductible versus non-deductible contributions to the TIRA.

Some years back, a change in the tax laws started allowing people of any income level to do conversions, where before the same “MAGI” applied to either Roth contributions ore conversions. This was blatantly an attempt to get high tax-bracket people to pay tax now.

A side-effect, probably unintended, is the “backdoor Roth”. This is where someone who has too high of an income to make a Roth IRA contribution and can’t deduct a traditional one, but has no traditional IRAs with pretax amounts makes a non-deductible contribution and shortly after converts that to Roth. The effect is very similar to just making a Roth contribution.

What gets some people in trouble is that the law requires the tax due to be calculated using the balances in all traditional IRAs at the end of the year, NOT at the time of the conversion. So some will do a backdoor Roth early in the year, and then later roll some pretax money out of a 401k into an IRA. Oops. The taxpayer has to prorate the pretax and aftertax portions of the IRAs for most distributions, including conversions. So if you contributed $7000 non-deductible and did a 100k rollover your conversion would be around 93% taxable. A recent change to the law removed the ability to undo a conversion.

This might be fodder for a Meryl post next week.

Many financial experts will tell you that there isn’t a substantial difference between a Roth IRA and a traditional IRA. If you take a given amount and either put it all in a traditional IRA or pay tax and put the remainder in a Roth, when it comes time to take it out, you’ll have more money in the traditional IRA but you will have to pay tax on withdrawals. Say your tax rate is 20%. $10,000 in the IRA or $10,000 minus $2,000 tax — $8,000 — in the Roth. Eventually, interest and dividends will give you $100,000 in the IRA or $80,000 in the Roth, but if you withdraw $100,000 from the IRA, you pay $20,000 tax and are left with $80,000.

You might say “But I’ll be in a lower tax bracket in retirement.” No. that $100,000 you take out of the IRA all counts as Adjusted Gross Income and puts you in a higher bracket.

However, there is ONE very important thing I found out after I started taking withdrawals. It’s Social Security and Medicare. If you get Medicare, you have to pay for Part B each month and it’s withheld from your Social Security check. How much do you pay? Well, that depends on your AGI. Distributions from a Roth don’t raise your AGI, and you pay low premiums. Distributions from a traditional IRA do, and you pay high premiums.

The key to backdoor Roth is that most who can’t contribute to a Roth directly can’t deduct traditional contributions. Also, for those of higher incomes, the contribution limit in plans like a 401k are relatively low. So that leaves a pot of money that needs to be invested. Taxable accounts are a solution, and with stock index funds not that bad. But Roth is even better.

Some of us were lucky enough to have yet another option, the Mega Backdoor Roth. Some 401k and similar plans allow contributing more than the deferral limit ($23,000 in this year). That money goes in after tax. The plan can then allow either an in-plan Roth rollover, or a rollover out to a Roth IRA. This allows, for those with a savings rate that supports it, the opportunity to get a lot more into Roth rather than taxable.

Brian – I am the sort of accountant like Gene Wilder in “The Producers” not the fancy ones which are more often portrayed.

To explain even better – a school friend also in accounting told me that he was transferred to “the small business” department. I asked how small – “clients who do not have a full bookkeeping department are small businesses”. I replied “Gee, I thought a client with a bookkeeper was a BIG business.”

My clients don’t get into complicated things such as 401K or a Roth. They might have an IRA they are withdrawing from. (At 70 I am a good deal younger than most of my clients.)

At this point I have a handful of clients – 4 tax clients and one business client other than Robert, me and our craft business (which is even smaller).

But I am still working and not retired as long as I have their taxes to prepare. Robert suggest every year that I tell them I not preparing returns any longer – but after all these decades I think it wrong to desert them.

zbicyclist/phsiii: This happened to me in real life, but with a sixth-grader. He was working on a problem that involved dividing 50 by 2. I told him “You can do that in your head. Think of money. You have 50 cents and we’re sharing it. How much do I get?” He gave me this condescending look at said “Ten cents”. I had to laugh, and corrected my question to “we’re sharing it equally“. Since then I always remember to include that word.